THE QUEST TO INVEST

Simplifying the investment journey through a digital learning experience

product description

Is an investment application that makes investing simple and accessible through bite-sized learning, guidance, and community-driven insights.

my role

Product Designer

tools

market segment

Figma, Notion, Pen & Paper

Fin-tech

product type

Digital investing platform

personal statement

methods used

Competitive Analyisis

User testing

User feedback Sessions

Despite having the resources to learn, I find investing challenging and intimidating due to the many unknowns and the high stakes involved. The potential consequences of financial decisions make it even more daunting, which is why I chose to focus on this project and sector.

1

2

Choosing an line of inquiry

Research

3

4

5

Insight Generation

Ideation

Second level of Ideation

1

Choosing a line of inquiry

THE INVESTING EXPERIENCE FOR THE MIDDLE CLASS

Through discussions with individuals in the middle class, I realized that many have the financial means but struggle with understanding and applying financial education, particularly when it comes to investing. They often face barriers such as

complex resources, time constraints, and a lack of trust in both themselves and external sources. This insight led me to focus on improving the investing experience for those who have resources but are held back by these challenges. This new direction aligned with my interests and offered a more meaningful exploration of financial literacy, particularly in bridging the gap between knowledge and application for people of different levels of knowledge.

THE TARGET AUDIENCE

Young adults in the middle class

Where,

Young adults - 18-26 years of age.

Middle class - Individuals who earn between Rs5 lakh and

Rs30 lakh.

- FROM LATEST PRICE-

ICE 360 REPORT

LINE OF INQUIRY

financial literacy

middle class

financial education

adult learning - andragogy

investing

From these conversations, a key concept emerged: financial literacy means different things to different people. This realization further broadened my perspective and influenced my decision to look at other areas where financial education could have a more significant impact.

young adults

Focus based on MPRA paper that identifies that the biggest gap in financial literacy is between young adults and adults

middle class

investing

WHY I CHOSE THE MIDDLE CLASS

India's middle class is one of the country's largest and fastest-growing segments of the population

Have the financial means to invest

ave access to financial education resources

THE BARRIERS THAT EXIST

Perception of finances

Complexity of systems

New investors overwhelmed with commercial applications

Knowledge-application gap

Less trust in financial decisions they make for themselves

WHY I CHOSE TO GO WITH DISPENSING KNOWLEDGE ON INVESTMENT PLATFORMS

Overwhelmed beginners : Many beginners download investment apps but quickly get overwhelmed leading to avoidance of investing

Building a Knowledge Base: Brings all users to a foundational level of knowledge for confidently using investment platforms.

Opportunity for education : The platform is an opportunity to provide financial education where it can be applied.

Addressing blind investing : Supports users who invest based on other's advice withour understanding the basics.

Introducing concepts: It helps users get familiar with different investment instruments.

Concept Refresh for Experienced Users: Allows users with some knowledge to refresh concepts as they encounter new terms or features.

2

Research

RESEARCH PROCESS

1

2

3

IDENTIFYING

STAKEHOLDERS

INTERVIEWING

STAKEHOLDERS

ANALYSING RESOURCES

AVAILABLE

1

IDENTIFYING STAKEHOLDERS

ABSOLUTE BEGINNERS

POTENTIAL INSIGHTS

Understanding what prevents those with no investment experience from trusting their own financial decisions and starting to invest.

CURRENT LEARNERS

POTENTIAL INSIGHTS

Identifying the challenges faced by those currently learning about investing, how they navigate available resources, and the process behind their decision-making (if any).

SELF TAUGHT LEARNERS

POTENTIAL INSIGHTS

Exploring the strategies used by individuals who have taught themselves, how they built confidence in their financial decisions, and the steps they took to reach their current level.

ADDITIONALLY,

FINANCIAL

EDUCATORS

who conduct investment classes and financial literacy workshops to gain insights into how people learn about managing their finances in these settings, the methods they use to conduct classes and to understand their perspectives on financial literacy.

2

INTERVIEWING STAKEHOLDERS

Interviewing people at random at Cubbon Park, Bangalore

I then set out to understand the types of users in depth. I had three main goals for my research, focusing on three types of people and the overlap between them.

INTERVIEW METHODOLOGY

These interviews were conducted in person, over a phone call or video call. Participants were picked randomly (within target audience) and chosen based on information I knew. I had 2 Google forms with me, one for beginners and one for self-taught learners which I subsequently filled out while having a conversation with them and asking them the contextual questions listed in the form. Interviews with financial educators were more free-flowing conversations based on their practice while following a loose structure that fulfilled the goals of the interview.

REASONING FOR THIS METHODOLOGY

I chose to do more interviews than data collection for the learners as I would be able to gain deeper insights while asking supporting questions to understand any tangential areas that come up in conversation. This would also help me understand their perceptions to finances in a better way.

A TRIP TO THE BOOKSTORE

During my visit to Cubbon Park, I had thechance to explore a nearby bookstore. This visit offered valuable insights into the printed resources available to the public, including their structure, content, and language. It helped me understand how financial topics are presented and made accessible to readers.

Number of people Interviewed

ABSOLUTE BEGINNERS

6

CURRENT LEARNERS

4

SELF TAUGHT LEARNERS

4

3

ANALYSING RESOURCES AVAILABLE

I obtained these insights from interviews from singular users who have interacted with the particular media/resource mentioned as well as consuming these resources myself and forming an opinion based on user views &feedback whilst validating it.

VARSITY BY ZERODHA - A LEARNING PLATFORM FOR INVESTMENTS

USER REVIEWS

Modules are too long

Too timetaking

Boring

The illustrations don’t make sense

The structuring of difficulties is nice

DESIGNER’S ANALYSIS

Monotonous content

Too much effort taken to learn

Accessibility of content is good

Descriptive content

Content is divided based on difficulty

Examples and case

studies for concepts

Difficulty levels are gauged by the

specificity of the topic and the

USER REVIEWS

Seems a little untrustworthy sometimes

Clickbait

Short content is easy to consume

More information in less time

YOUTUBE SHORTS

DESIGNER’S ANALYSIS

Isn’t structured learning

Information doesn’t lead to each other

Discovery of resource is by chance.

Is only understandable to a certain group of people

YOUTUBE VIDEOS

USER REVIEWS

More informative

Deep insights

Personal touch

Accessible

Easily understandable

Too much interest is required to learn

Too much commitment

Increased load on memory to remember topics

Application is a little hard sometimes

DESIGNER’S ANALYSIS

Structured

Concepts are woven together

Use of visuals

Storytelling as a medium

Smaller chunks of information that are joint together

DESIGNER’S ANALYSIS

Structured

Easy language

Relatable

Concepts flow into each other

Can get boring at certain points

Too timetaking

INVESTING FOR DUMMIES -

Eric Tyson

This gave me a basic understanding of the user’s perceptions on the resources that exist out there as well as the characteristics of each resource, what is working and what is not. As you can see, most of the gaps identified link back to the complexity, transparency, fun factor, structuring or commitment needed for a resource.

3

Insight generation

INSIGHTS FROM INTERVIEWS

FINANCIAL EDUCATORS

Individual who takes trading classes online

I learned about his approach to teaching financial literacy and the challenges his students often face. He defines financial literacy in terms of investment knowledge and strategy, measuring success by the ability to earn returns. Most of his students are young adults between 18 to 30 years old, coming in with different levels of knowledge—some know little about the stock market, while others have more information but lack the strategy to achieve returns. Many are motivated by the idea of earning passive income and sometimes view trading as a quick way to get rich. Mr.Sanjay emphasizes that financial literacy requires patience, strong analytical skills, dedication, and avoiding greed. He teaches students his proven strategies while encouraging them to create their own. A common challenge they face is understanding and analyzing financial data, which headdresses through consistent practice.

Individual who conducts financial literacy workshops

Believes that financial literacy is a long journey—no one can be completely financially literate. He emphasises starting with the basics, as having a strong foundation helps people teach themselves more complex concepts when they're ready. He highlights the importance of learning how to manage money, especially so people can reach a point where they’re able to invest. His teaching approach is highly practical, focusing on learning by doing. He uses activities and real-life scenarios to engage students and make the topics relatable. When teaching, he stresses the need to stay neutral, simply providing clear information about financial instruments and their pros and cons. He encourages people to make decisions based on their own motivations and understanding. Setting goals for learners is important, as it keeps them motivated, and using simple, easy language helps them connect with the material.

A place to practice is required, creating an environment where people can make mistakes and learn through trial and error.

Teaching people skills and not just theory

SELF TAUGHT LEARNERS

Interact with the FigJam board to explore insights. Click the button on the top right corner of the board to view in full screen.

BEGINNERS

Interact with the FigJam board to explore insights. Click the button on the top right corner of the board to view in full screen.

PERSONAS BASED ON INTERVIEWS

I created personas based on the number of interviews I took to understand who I was designing for better.

4

Ideation

FIGURING OUT PARAMETERS FOR THE INTERVENTION

By the end of the interviews, I had gathered several recurring insights that needed to be integrated into my outcome. These insights helped establish a clear set of parameters that would guide my intervention. While these parameters were flexible, they provided the necessary direction to shape and refine the intervention moving forward.

My project needs

something that facilitates/is:

conversations and advice on investments

learning by doing

exploration by themselves

easy intake of information

assessment of knowledge

providing a safe space to faulter for beginners

participating in intake of information by choice

undertanding of more complex content available on demand

visual rich

a connection between the actual investment application, concepts and the application of those concepts

low effort easily accesible information

IDEATION BASED ON INSIGHTS

I took the different insights separately and solved for that specific insight. I then pieced these together to form a sense of intervention I was going to develop.

From the insights, it was clear that I had to create an educational module/s to make people aware of the ways they could be investing their money, and how to go about doing it therefore increasing their confidence in the decisions they made for themselves.

IDEATION FOR MODULES

Interact with the FigJam board to explore insights. Click the button on the top right corner of the board to view in full screen.

IDEATION FOR ASSESSMENT

Assessment of concepts was just as important as teaching concepts to people in order to help people gauge their understanding of such concepts hence helping them identify gaps in their knowledge and work towards bridging them.

Interact with the FigJam board to explore insights. Click the button on the top right corner of the board to view in full screen.

5

Second level of Ideation

Choosing Upstox as a base to build on

I chose Upstox as the base for my project because my focus was on embedding learning into existing investment platforms. Upstox stood out for its simplified design, user-friendly interface, and features that cater to users at various levels of experience. Its non-overwhelming UI makes it approachable for beginners, while its functionality supports a range of user intents. This makes Upstox an excellent example of an investment app designed to accommodate diverse needs effectively.

RESEARCH PROCESS

1

2

3

MODULES

DEMO INVESTING

COMMUNITY AND SHARING

1

MODULES

WHAT IT IS

Modules serve as the medium for delivering information in bite-sized, digestible pieces of investment knowledge. Accompanied by visuals, these modules are strategically placed within the platform in contextually relevant areas. For instance, a module explaining line graphs would be accessible right where users encounter a line graph. This approach meets users at the point of need, addressing doubts as they arise and enhancing the learning experience.

STRUCTURING MODULE CONTENT FOR EFFECTIVE LEARNING

To ensure the modules provide valuable learning and help users understand financial topics to a level of competency, I focused on creating a standardized content structure. Templatizing the modules was essential for maintaining continuity in the learning style, so I developed a guide informed by adult learning techniques and levels of learning. This process helped me align the content with both the medium and the intent of the users.

PLANNING

- A basic definition

- Application of it in real life - through a case study or a story

APPLICATION

- Show users where it is located within an application.

- Trial run of the activity to be carried out, with guiding.

DEEP UNDERSTANDING

- Asessment of concept,

- If theory, through multiple choice questions.

- If tangible concept that requires interaction with digital tool, through a practice run

The structure was inspired by this study done that analyses 'Characteristics and Consequences of Adult Learning Methods'

(Trivette et. al 2009, 3)

UNDERSTANDING USER INTENT

Adults using an investment application typically do so out of curiosity or a specific need to invest. Their primary goal is not to"learn" in the traditional sense but to understand what they are dealing with and how to navigate it.

THE IMPORTANCE OF USER INTENT

While designing, I had to constantly remind myself of the users' intent and their primary motivations for using an investment application.

It's easy to get lost in your ideas.

To align with this intent, the module content needed to:

Provide foundational knowledge to help users grasp key concepts without overwhelming them.

Reduce cognitive overload, which is a common challenge for beginners navigating investment applications.

Set the stage for users to conduct deeper research independently, fostering self-driven learning.

By focusing on contextual relevance and breaking down complex concepts into manageable pieces, the modules aim to support users in their immediate needs while encouraging confident and informed decision-making.

SKETCHING AND ITERATING ON FORM

Accessing modules: Where does the user interact with these modules?

I went with the first idea through the process of elimination. I also got feedback from learners to understand what seemed the most reasonable to them.

Picture from feedback session

FIRST ROUND OF FEEDBACK

From 5 individuals of varying levels of expertise

I explained the concept of modules whilst showing them the prototype and got feedback on whether they thought this would be helpful

“The module is very simple to understand”

This is with regards to the breaking up of content into smaller pieces and using language that is explanation and easy to comprehend

“The modules are a little hard to find”

Users liked the introduction of modules and placement of modules on the Stock page, but could not locate the contextual modules (the ones placed under the ‘i’ icon.

“I like the visuals they’re so cute.

The visuals helped reduce the feeling of being overwhelmed by financial topics, they also helped in creating a narrative, which consequently aided in learning.

AFTER FEEDBACK

Introduction of concepts on stockpage itself

I assigned a symbol to represent the learning modules, choosing one that is striking and easily recognisable. Upon first using the app,users will be guided through a tutorial, wherethey will be instructed to look out for these symbols and understand their meaning. This ensures that users can quickly identify the learning opportunities throughout the app and engage with them effectively

Accessing modules after clicking on the symbol

2

DEMO INVESTING

WHY DEMO INVESTING

“These stock market games are a form of experiential learning that give controlled exposure to markets without the risk of real financial losses. Mandeli (2008) finds that participation in a stock market game results in a 6-8 per cent improvement in financial literacy among respondents. These studies suggest that financial experiences make people more receptive to financial education programmes, and improve financial literacy and financial behaviour.“ (Frijns, Gilbert & Tourani-rad 2014, 149)

Demo investing provides a risk-free environment for users to experiment, test strategies, and familiarize themselves with the processes involved in online investing. Integrating demo investing into an existing platform ensures a seamless transition between practice and real investing, while offering real-time data to create a realistic and engaging learning experience. It also serves as an additional medium to embed financial education directly into the user experience. This approach aligns with the preferences of adults, who often learn best through experiential methods. By allowing users to engage directly with the tools and processes, demo investing becomes not just a practice space but also a practical medium for embedding financial education into the user experience.

Lets take StockGro, a demo investing application avaialable on the play store

-

Falls short in addressing the comprehensive learning needs of beginners.

-

The platform primarily focuses on providing fake money for practice but does not offer guidance on understanding investing concepts or processes.

-

This lack of educational support often leaves users confused, undermining its potential as a learning tool.

IDEATION

FOR DEMO INVESTING

This was my process for ideating the functionality of demo investing. I needed to determine how to seamlessly integrate the learning modules into the platform and design the mechanics of the virtual portfolio.

I had also looked into what are the pain points of current demo investment platforms,

Demo platforms often fail to provide a realistic investing experience because the data is not real-time, and users lack an emotional connection to the virtual money they are spending. This detachment leads to reckless behavior, as users tend to make decisions they wouldn't in real life. While the experience may give the illusion of success, the reality is that users are overspending unrealistically large amounts, which skews their perception of actual investing.

Therefore, my ideation focused on creating a demo experience that felt realistic while also serving as a safe space for trial, error, and learning. The goal was to bridge the gap between simulation and reality, encouraging users to develop practical investing skills in an engaging and risk-free environment.

THE RESULT

The demo investing experience is personalized based on the user's goals.

The first option is designed for beginners, whose main aim is to apply the concepts they've learned from the modules or their own research. They also want to familiarize themselves with the app’s interface. To support this, the demo investing platform mirrors the regular platform ,with the only difference being the use of demo funds instead of real money, ensuring users feel comfortable navigating the app without any pressure.

The second option caters to day traders and seasoned investors. These users use the demo platform to experiment with trading strategies or make mock investments, allowing them to test their knowledge and predictions without real financial risk. This helps them refine their skills and assess the effectiveness of their strategies in a risk-free environment.

Upplars, the fake currency

used on the demo platform, help users easily distinguish between the demo and real investing environments. This ensures a clear separation, allowing users to practice confidently without any confusion or risk.

Demo investing is kept separate from the regular investing platform

to avoid any confusion or mishaps, ensuring that users can easily distinguish between their practice environment and real investments. The only difference is the colour scheme and the banner that says ‘DEMO PLATFORM’ on top.

Users can choose to receive their fake funds in either monthly installments, mimicking a more realistic investing scenario, or as a one-time lump sum. This customization allows users to tailor their demo investing experience while reinforcing real investing practices, particularly with the monthly credit option, which helps maintain a tight budget

2

SHARING AND COMMUNITY

Family plays a significant role in shaping the financial habits of young adults in the middle class. The environment one grows up in strongly influences money management and decision-making. Beginners often consult parents or trusted relatives when making financial choices, and as families grow, financial goals often shift, making investing a family-oriented decision.

Additionally, financial education spreads within social networks, as individuals often share new knowledge with family, friends, or peers. This exchange helps communities adapt to evolving financial landscapes and opportunities.

Whatsapp chat with my father (Appa)

An example of how investing advice is dispensed

Investment advice is widely shared in India, reflecting the power of the community in financial decision-making. In one study,91% of respondents expressed a willingness to recommend financial planning to friends, relatives, and acquaintances. For example, my father often sends me text messages and asks me to call him to ensure I’m making the right choices in buying stocks. Similar exchanges happen frequently among friends, colleagues, and advisors.

THE PROBLEM

These interactions often rely on less efficient communication platforms, requiring significant coordination.

THE NEED

Solution that streamlines and optimizes the sharing of financial advice.

THE FEATURES THIS TRANSLATED TO

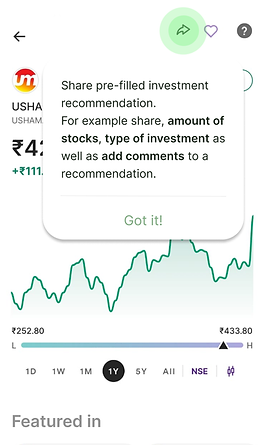

SHARE ADVICE FEATURE

makes it easy for users to share and receive stock tips or financial advice

Comment feature

helps with conveying advice or other text based information.

Pre-filled form

makes it easy for beginner users facilitates learningby helping beginners get usedto the interface makes it easier to convey specific information

SHARE PORTFOLIO FEATURE

Allows users to share their investment portfolios with trusted friends, family, or advisors in a simple and secure way. Instead of using external platforms or lengthy explanations, users can provide a clear overview of their holdings directly within the app.

This feature makes collaboration easier, allows trusted individuals to keep track of your holdings, and facilitates learning by encouraging discussions about strategies, successes, and areas for improvement. It’s a seamless way to stay informed and gain valuable insights from others.

REFLECTION

This project has been a valuable learning experience, deepening my understanding of adult learning (andragogy) and the specific needs of adult learners in financial education. Having personally struggled with financial literacy, this journey felt especially meaningful and motivated me to design solutions that address real challenges.

A key takeaway was the importance of understanding user intent. Users engage with investment apps to either invest or explore options, so designing concise, contextual modules tied to their actions was critical.

Adults value focused, goal-oriented learning, making bite-sized lessons essential.I also recognized the significance of community in financial education. Adults often learn through discussions with peers, family, or friends. This inspired features like portfolio sharing to foster social interaction and shared knowledge, emphasizing that financial education thrives in collaborative environments.

Moreover, I learned the importance of designing the experience, not just the content. Integrating modules naturally within the platform, ensuring accessibility, and adding supportive features were key to creating a seamless learning journey.

Finally, this project clarified my role as a designer—not to create content, but to craft experiences that facilitate learning. Every design decision aimed to make financial literacy intuitive, engaging, and empowering for users.

FUTURE PLANS

User Testing and Feedback Loops: The next step will be to conduct thorough user testing with a broader demographic. This will help validate the design choices, identify pain points, and refine features to better meet user needs. Gathering feedback on specific modules and interactions will be crucial in fine-tuning the learning experience.

Personalization and AI Integration: A future enhancement could involve leveraging machine learning or AI to personalize the learning experience further. By analyzing users' behavior and learning patterns, the platform could suggest relevant modules, tailor content to their individual goals, and provide more targeted advice based on their investment history or preferences.